Tax Prep & Adviser

Our Tax consultation not limited, we do have a variation of services in Tax Prep and Filling, IRS aduiting issues, Business Consultation and Inheritance Tax

There are a many challenges if we are not getting done our day to day mailling documents on time we'll going to have other new challenge to deal with. Also, if you haven't get done your tax filling on time you will be getting the late penalty fee. So Express Consulting team is on your side to help you for these challenges.

The tax return is one of the import thing that as a taxpayer or bunisess owner you have to file on time and have to be done in a propor way to avoid the IRS audits and try to get your maxuimum refund. Express consulting will help you to get your desired refund.

Express consulting service always is open for helping the customer on thier needs to advised and consultanted.

Our Tax consultation not limited, we do have a variation of services in Tax Prep and Filling, IRS aduiting issues, Business Consultation and Inheritance Tax

Our Legal consultation not limited, you will be getting a attornty for your business Consultant, inclouded not limited Legal Consultation, and Business legal Consultation

Express consulting specialty services depending on your needs. Express consulting will never let you go to searsh by your own on your immigration and documents translation.

Our team is self driven team and know what is the best for thier customer, will help you and get you to the right direction.

Thank you for bringing your matter to our attention! please put your full name, email, phone number, and submit your request. Our customer service team will respond to your request within the prioritized list, and will getback to you as soon as possible.

A tax return is a documentation filed with a tax authority that reports income, expenses, and other relevant financial information.

On tax returns, taxpayers calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes. In most places, tax returns must be filed annually.

A tax return is necessary when their earned income is more than their standard deduction. The standard deduction for single dependents who are under age 65 and not blind is the greater of: $1,100 in 2022

There are various types of tax return preparers, including certified public accountants, enrolled agents, attorneys, and many others who don't have a professional credential.

read more

The IRS will calculate the Failure to File Penalty in this way: The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won't exceed 25% of your unpaid taxes.

read more

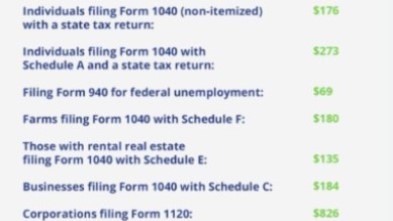

According to a recent study by the National Society of Accountants, the average cost of getting your taxes done is $261. For business you can expect to pay about $350-520 to get your taxes done.

read more